Very mobile payment alternatives give flat fees, so it’s possible for you to funds monthly or one-fourth. Cost and you may control fees accounted for 25% of our own weighted rating. Shopify are a popular all of the-in-you to e-trade service you to definitely allows you to make a website, online website, and includes POS application to deal with your online business. What’s more, it also offers a method for on line vendors for taking payments personally which have a cellular cards reader. The new credit customers prices $forty-two for each, along with your transformation from cellular software connect with your Shopify POS software.

Ink Company Well-known Bank card

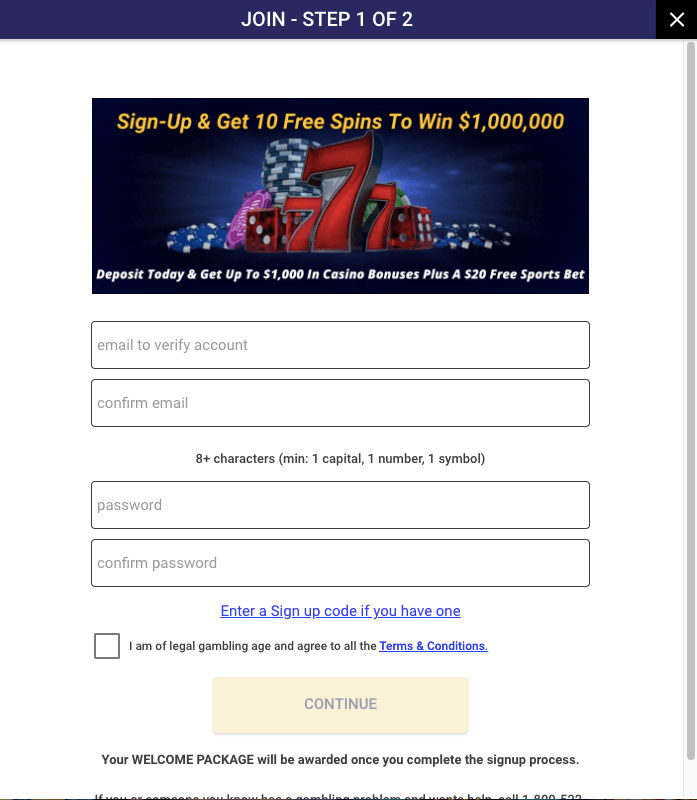

This site will send you a verification text when your account might have been paid. The amount of time taken for it that occurs varies from gambling establishment so you can local casino, it may be just moments or a couple of days. How much cash credited to the gambling enterprise account have a tendency to today be included on to your next mobile phone expenses and also you are prepared to play a favourite casino games.

Of numerous small company credit cards and some debit cards can also be eligible getting added. Although not, not all the debit cards and many prepaid service cards can also be’t be included. The best-profile exemplory case of this is the Fruit Card, which offers dos percent benefits (step three percent to own Fruit items) and some most other awesome possibilities. PayPal and you can Venmo both provide borrowing and debit notes, and money App’s debit cards periodically offers some really deep savings. Samsung also provides a credit and you may a no-commission, interest-influence money government account available with SoFi.

Much easier possibilities to invest by the cellular phone bill services are ewallets for example you need to use from the Skrill, Neteller, and Trustly casinos. This really is perhaps the easiest way to use the fresh shell out by the cellular option. You’ll establish the transaction through an Text messages, as well as the count you placed would be added to their cellular telephone bill at the end of the brand new month, which you’ll then spend while the regular. When you are delivering a new cellular phone, the new company does a credit score assessment to decide if you be eligible for financing and you may under just what terminology. Even if you’re also fundamentally getting lengthened financing to pay for your brand-new mobile phone, the new costs won’t be in person advertised for the credit agencies and you may obtained’t help your credit score. ZestMoney users don’t need a charge card to purchase a good cellular for the EMI.

They could’t accessibility your bank account, include otherwise organize items, otherwise create a different checking account – all https://vogueplay.com/au/royal-vegas-casino-review/ the profits try relocated to your bank account. From the account, you might comment product sales records for team connected to your account. There are a selection away from firms that offer mobile repayments programs. Nevertheless preferred try Fruit Spend (Apple’s cellular money solution) and you will Google Spend (Google’s mobile costs provider). When you have a more recent make of an ios otherwise Android tool, it’s likely that it can assistance a mobile repayments app.

Here’s what it will cost you to accept borrowing from the bank and you may debit card transactions having fun with Shopify Repayments for each away from Shopify’s chief prices plans. Individualized running charges are for sale to highest, high-frequency enterprises from Shopify As well as package. To have age-commerce companies that open pop music-right up shops and want a method to take on credit cards in the person, we recommend Shopify Payments – the brand new in the-house credit card handling service given by Shopify. Which cloud-founded elizabeth-business program provides over 800,100 merchants around the 175 places, along with really-known brands including Nestle and you may Red Bull.

Perfect for Samsung users

- After you have your own card, digital or real, put it to use to expend on line by entering the unique 16-digit password whenever caused.

- You’ll be asked to follow some specific prompts doing their exchange, just before guaranteeing it.

- Experian Boost try an online tool that enables one to offer permission so you can Experian to access your bank account and you can pick electricity and you will telecom payments.

If you don’t, you could potentially consider dollars-right back credit cards that don’t limit their higher-money benefits to particular spending classes. Listed below are seven notes that will make it easier to optimize your portable payment. To accept mobile costs at the store, you should get a place-of-sales equipment one’s armed with NFC technology, such as the Rectangular contactless and you can processor chip audience.

Once couple of years, concerns drop off your credit report totally. Visit Flipkart, discover your cellular, and you can during the checkout have fun with ZestMoney since your cellular financing fee alternative. Unlike protecting tough-earned currency to own weeks or diminishing on the collection of mobile, you can choose get cellular for the EMI. Don’t loose time waiting for weeks if you’re able to without difficulty pick a cellular to the EMI in your area.

Then, very banks have a zero-liability plan for bank card con, meaning if you were duped, you don’t need to shell out one thing (that have specific practical restrictions). All characteristics also use ripoff recognition technical to guard your, also. Tap to save money straight back now offers of finest brands one which just store.step 1 And, post currency, tune packages, manage your currency, and so much more from the PayPal app. Because the another offer to possess customers for the website, you’ll rating a 4GB Study Increase during the no additional cost whenever you activate a new 1pMobile SIM credit.